Simplified Version

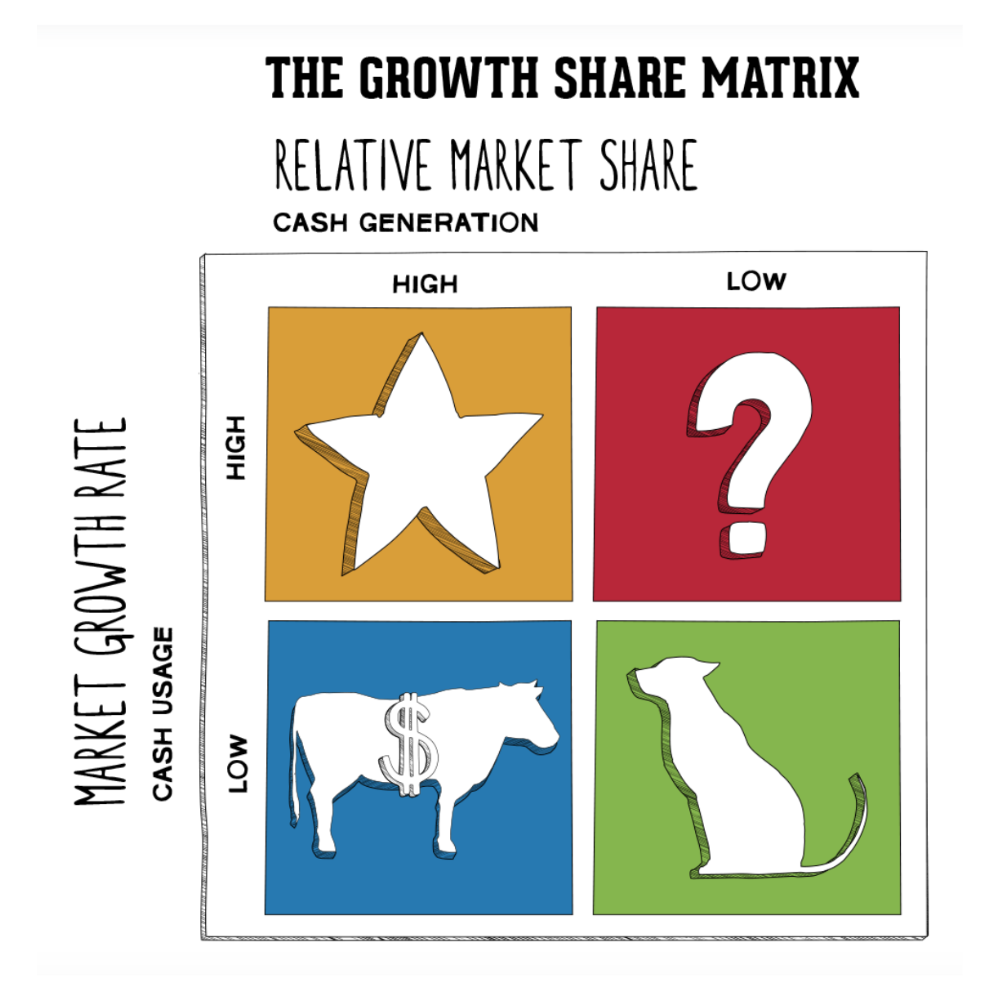

BCG Growth-Share Matrix

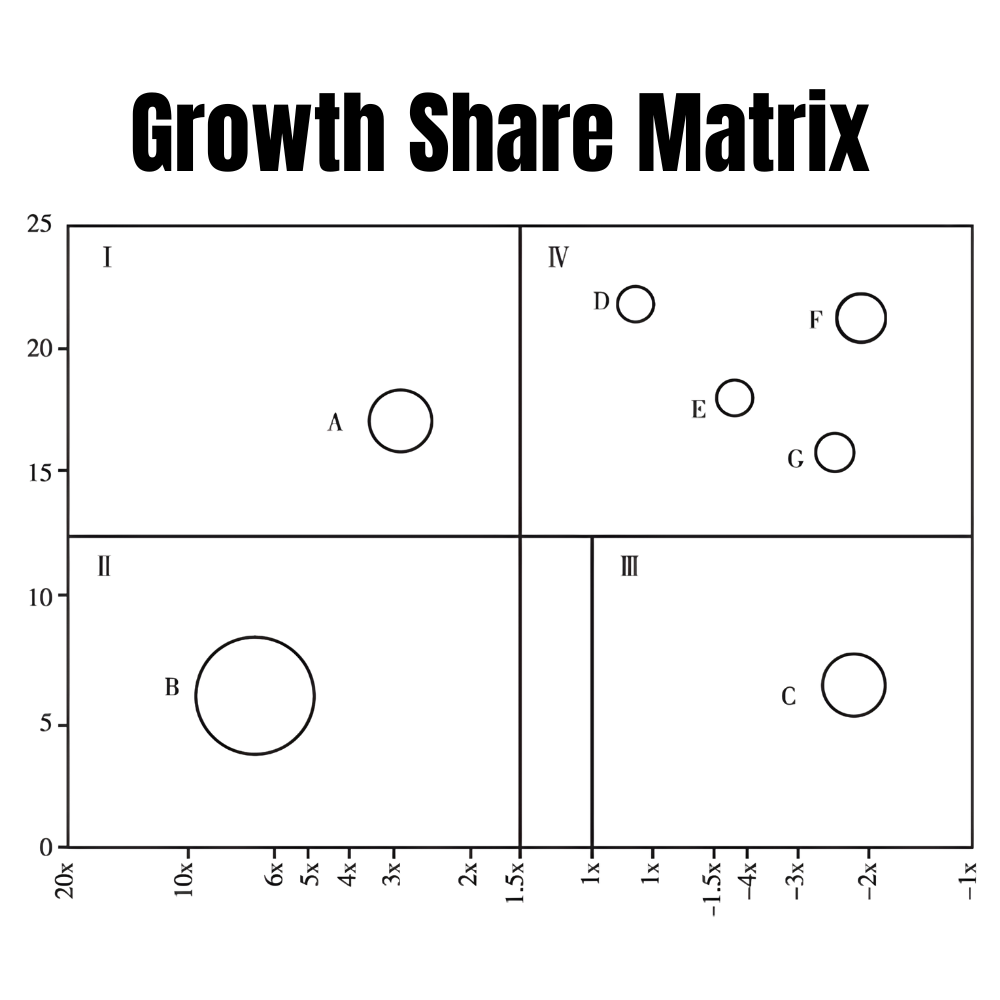

The BCG Matrix, also known as the Growth-Share Matrix, classifies business units or products into four categories (Cash Cows, Stars, Question Marks, and Dogs) based on market growth rate and relative market share.

- Cash Cows: Low growth, high market share businesses that generate steady cash flow with minimal investment.

- Stars: High growth, high market share businesses that require significant investment to sustain growth.

- Question Marks: High growth, low market share businesses that require careful analysis to determine if they can become Stars or should be divested.

- Dogs: Low growth, low market share businesses that may drain resources and should be divested or repositioned.

Original Version

BCG Growth-Share Matrix

Walter Kiechel III discusses the BCG Matrix in “The Lords of Strategy,” including the scales used on its axes, which are crucial for categorizing business units.

Market Growth Rate (Y-Axis): The threshold is often set at 10-12%. This percentage delineates whether a market is considered high growth or low growth. Business units in markets growing faster than this rate are placed in high-growth categories (Stars and Question Marks), while those growing slower are considered low-growth (Cash Cows and Dogs).

Relative Market Share (X-Axis): The threshold is typically set at 1.5x. This means a business unit’s market share is compared to the market share of its largest competitor. A relative market share greater than 1.5 indicates a strong competitive position (Stars and Cash Cows), while less than 1.5 indicates a weaker position (Question Marks and Dogs).

Greetings from Altipex.com

Being a passionate believer in Simon Sinek’s “Golden Circle” concept, which consists of three concentric circles labeled “Why,” “How,” and “What.” Everything we do, we start with “Why”.

With over 15 years of experience, we specialize in:

- Strategy: where-to-play, how-to-win.

- Branding: making a difference.

- Marketing: connecting with purpose.

If you require consultancy services, please feel free to contact us.